Fireside Chat: The Future of Supermarket Experience, with Edu Lizana from Uber Groceries

As we look toward 2023 and beyond, we can all agree that the transformation of grocery retail delivery that started during COVID is going to continue well into the future.

Uber’s Cornershop, Instacart, DoorDash and many other grocery delivery services have been making significant gains. Instacart earned $1.8 billion in 2021 alone. Uber bought Cornershop in 2021 at a $3 billion valuation. DoorDash continued in 2022 to increase the number of partner supermarkets, including Sprouts and Giant Eagle.

Eduardo Lizana Yaksic

Tell us about yourself

Right now, I’m the Head of Central Ops Strategy for Latin America, Uber Groceries. I have been focused for the past 2.5 years to improve our quality and efficiency across the region. I’m an engineer with a background in logistics and consulting. I have spent my career “getting things done,” implementing technology projects to resolve operational challenges.

What is Cornershop by Uber? How does it work?

The short answer is that Cornershop by Uber delivers orders to your doorstep, such as groceries, apparel, convenience, etc. However, the logistics behind it aren’t as simple as just sending shoppers, also known as pickers, running around town.

Shoppers are working in both dark stores – warehouses set up purely for the purpose of filling delivery orders – and “regular” supermarkets, winding their way around the direct consumers that are doing their own shopping.

Source: CMA

What about the role of pickers?

Right now, shoppers have a long learning curve. They are being sent to a variety of stores where they must try to figure out where to find the items on their customers’ lists. It takes quite a while before they learn where the most commonly picked items are, and their earnings reflect this. Many simply quit because they aren’t earning enough in the beginning to make the job worthwhile.

What about picker retention?

Shoppers are essential to grow this business, if a company does not solve this they just won’t be successful in the long term.

It’s a stressful job; you need to pick the right items, be on time and diligent, so some people just don’t stay for long. Also, they need some sort of stability; if they’re making $100 one day and $10 the next, then it just won’t be sustainable as a primary source of income.

The best pickers are good under pressure and learn quickly. When my girlfriend and I were shoppers in the US, I folded under the pressure while she packed twice as many orders as I did.

Let’s turn that around. What about customer retention?

This is a tricky one; on one side if we charge too much to pay shoppers well we won’t have enough customers or volume. If we charge too little we won’t be able to sustain the business in the long term. Therefore, a big focus for anyone offering a delivery service should be to be efficient. By having pickers fill orders as quickly as possible, they’ll be able to fill more orders in less time, make more money, and keep both the pickers and our customers happy. It’s a win-win.

In addition to speed, customers expect to get all the items they ordered, and in case a picker gives up on finding it, items will be missed, leading not only to smaller basket sizes, but also lower satisfaction and retention.

What about the future of grocery delivery from the retailer’s perspective?

Retailers are going to continue to grow their dependency on data, which could be leveraged with AI. They are already using data to fine-tune the online experience and learn from customers’ grocery orders and offer last-minute deals to increase basket sizes, mimicking the “impulse” purchases you do closer to the cashiers at the supermarket.

Also, as they focus on growing customer loyalty programs, they’ll be able to leverage data to drive customers back to the stores based on their past behaviors.

Learn more about proximity marketing.

What do you see for the future of the grocery in-store retail experience?

Brick-and-mortar stores are set up to increase customer purchases; “hot” products like bread are on the back to make you go through the whole store first. Also products are grouped in categories so they will be easier to find.

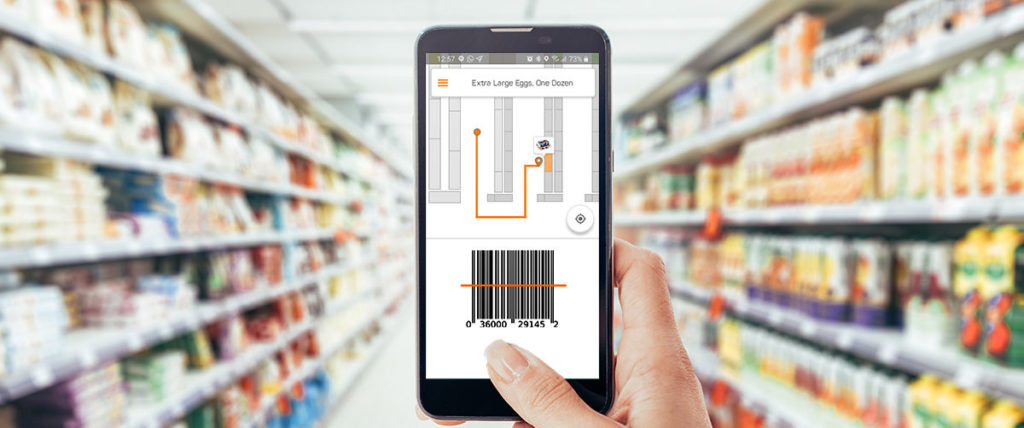

When it comes to dark stores, the customer has already made the purchase, so what matters now is speed. Dark stores can leverage real-time navigation to speed the picker journey and get the insights they need to be able to redesign their layouts to speed picking.

In retail stores, by having real-time customer journey data, they will be able to know who is shopping and offer customized last-minute deals to increase basket sizes.

What do you think about the future of technologies like scan & go apps?

The checkout is just a bad experience. For the customer and retailer. The customer has to wait in line and during the scanning process while the retailer must have headcounts and cashiers that are just taking up space and cost money. A big line sometimes means customers just decide to leave.

Today, major retailers are trying to solve this problem by implementing technological alternatives, trying to find a balance between the risk they are willing to assume and the return in terms of money and floorspace .

I think checkouts will probably suffer substantial transformations in the next 5-8 years.

Retailers will increasingly be leveraging the data from their loyalty programs and combining it with real-time navigation to understand what customers are really buying and how to design the stores accordingly – while trying to find a balance between efficiency and encouraging impulse buying.

Anything else you’d like to add?

I think indoor navigation has a huge potential to change the user experience in a lot of places like airports, malls or grocery stores. This not only will make everything easier but also save money, so the companies’ buy-in shouldn’t be too hard. The only thing forward is to educate the industry about these emerging technologies fast enough and have a great UX to help with the adoption.

Thanks, Eduardo, for taking the time to speak with us today. We look forward to hearing your thoughts about the future of retail any time you’d like to share with us again.